"SQUISHY" @ 8 Months

Gulf of Mexico Oil Spill Blog Stats

- 671,538 hits

Gulf of Mexico Oil Spill Blog

-

Join 396 other subscribers

Gulf of Mexico Oil Spill

- Guatemala Análisis de Agua (1)

- Gulf of Mexico Oil Spill Blog (1,862)

- 99ers (1)

- Africa (3)

- Alabama (60)

- Alabama Tourism (1)

- Baldwin County (2)

- Gulf Shores (15)

- Mobile (8)

- Montgomery (1)

- Orange Beach (3)

- Alaska (17)

- Algeria (5)

- Amberjack (1)

- Anadarko (2)

- Anadarko Stock (1)

- Anonymous (3)

- Cyberwar (2)

- Appropriation Art (1)

- Arctic Oil Drilling (2)

- Australia (2)

- Azerbaijan Giant Gas Leak (1)

- Backlash (1)

- Bahrain (9)

- Banksters (1)

- Benzene (2)

- Biflation (5)

- Billy Nungesser (4)

- Biofuels (18)

- Hemp (11)

- Bioremediation (1)

- Blue Fin Tuna (4)

- Bodypainting (1)

- Bolivia (1)

- BP (7)

- Brown Pelican (1)

- California (6)

- Redondo Beach (1)

- Cameron International (1)

- Canada (4)

- Casinos (2)

- Cherri Foytlin (10)

- Chile (2)

- China (15)

- Claims (34)

- Climate Change (1)

- Coffee (3)

- Cook Inlet (2)

- Beluga Whale (1)

- Coral Reefs (3)

- Corexit (21)

- Cuba (3)

- Custom Wood Signs (1)

- Dauphin Island Sea Lab (1)

- Deep Sea Fishing (1)

- Depopulation (1)

- Detoxification (2)

- Deurbanization (1)

- Dolphins (34)

- Donovan Law Group (6)

- Ecosystem Sustainability (1)

- England (1)

- Environment (2)

- EPA (3)

- Eygpt (23)

- Cairo (1)

- Face Painting (1)

- FDA (6)

- Federal Reserve (29)

- Ben Bernanke (13)

- Fishing Charters (3)

- Florida (84)

- Apalachicola (8)

- Apalachicola Bay (7)

- Bay County (1)

- Destin (7)

- Eastpoint (10)

- Escambia County (3)

- Florida Hotels (2)

- Florida Keys (2)

- Jacksonville (3)

- Navarre Beach (1)

- Panama City (6)

- Pensacola (9)

- Pensacola Florida (7)

- Deluna Fest (1)

- Sarasota (1)

- St. Petersburg (3)

- Tampa (5)

- Apalachicola (8)

- Follow the Money (134)

- Judge Carl J. Barbier (13)

- Kenneth Feinberg (92)

- France (2)

- Free Money (1)

- Gag Grouper (2)

- Genetic Modification (3)

- Geohazard (4)

- Germany (3)

- Gold (5)

- Goth (1)

- Grants (1)

- Greece (3)

- Green Jobs (1)

- Greenpeace (9)

- Gulf Coast Ecosystem Restoration Task Force (1)

- Gulf Coast Real Estate (6)

- Gulf Fishing (7)

- Gulf of Mexico (1)

- Gulf of Mexico Oil Spill 2010 (148)

- Gulf oil spill (160)

- Gulf Oil Spill Books and Films (20)

- Gulf Seafood (11)

- Gulf Stream (2)

- Gulfport (2)

- Halliburton (4)

- Halloween (1)

- Hyperinflation (38)

- Illinois (3)

- India (2)

- Indiana (2)

- Indians (2)

- Inflation (39)

- Interior Design (1)

- Israel (2)

- Japan (54)

- Jesse Anderson's Cross Country Trek to Impact Oil Spill (1)

- Keystone Pipeline (7)

- Kitchen and Bath (1)

- Lady Gaga (1)

- Libya (23)

- Az Zawiyah (1)

- Benghazi (3)

- Muammar Gaddafi (1)

- Lingerie (1)

- Loans (1)

- Louisiana (80)

- Mardi Gras (1)

- Matterhorn SeaStar Oil Spill (1)

- Meeting (1)

- Memorabilia (1)

- Mesa Restaurants (1)

- Mexico (6)

- Michigan (1)

- Microbes (6)

- Microbial Enhanced Oil Recovery (2)

- Mini Spills (1)

- Minnesota (1)

- Mississippi (18)

- Bay Saint Louis (1)

- Biloxi (1)

- Gulf Coast Research Lab (1)

- Mississippi Barrier Islands (3)

- Montana (4)

- Morocco (2)

- Mutation (2)

- National Audubon Society (2)

- Nevada (1)

- New Orleans, Louisiana (102)

- 9th Ward Neighborhood (6)

- Coffee (2)

- Downtown (2)

- Faubourg St. John (1)

- Faubourg Tremé (3)

- Treme (1)

- Food Bank (1)

- French Quarter (30)

- Antoines Annex (2)

- Cafe Amelie (1)

- Cigar Factory New Orleans (1)

- French Market (1)

- Galatoires Restaurant (2)

- Iconography @ Vintage 329 (2)

- Magnolia Grill (1)

- P&J Oyster Co (1)

- Royal Street (1)

- Roux Royale (1)

- Tipitina's (1)

- Toulouse Street (8)

- Boutique du Vampyre (1)

- Glass Magick (3)

- Olivier House (1)

- Halloween Parade (1)

- Hotels New Orleans (2)

- Hydroponics Kits (1)

- Internet Cafe New Orleans (2)

- Marigny Bywater Neighborhood (7)

- New Orleans City Park (1)

- New Orleans Hotels (1)

- New Orleans Housing (1)

- New Orleans Jazz (1)

- New Orleans Jobs (1)

- New Orleans LA (3)

- New Orleans Restaurants (1)

- Pralines (1)

- The Garden District (11)

- Magazine Street (9)

- Audubon Zoo (2)

- Courtyard Grill (1)

- Design Within Reach (2)

- Mystic Blue Signs (2)

- Magazine Street (9)

- The Mortuary New Orleans (1)

- The Rib Room (1)

- Uptown (1)

- Voodoo (1)

- New York (3)

- Potsdam (1)

- NOAA (9)

- Norway (1)

- Nuclear Power (1)

- O’Brien’s Response Management (1)

- Occupy Wall Street (86)

- Occupy Albany (1)

- Occupy Albuquerque (1)

- Occupy Atlanta (1)

- Occupy Austin (1)

- Occupy Baltimore (1)

- Occupy Bismarck (1)

- Occupy Boise (1)

- Occupy Boston (1)

- Occupy Chicago (1)

- Occupy Cincinnati (1)

- Occupy Colorado Springs (1)

- Occupy Columbus (1)

- Occupy Concord (1)

- Occupy Dallas (1)

- Occupy Dayton (1)

- Occupy Denver (1)

- Occupy Detroit (1)

- Occupy East Point Florida (1)

- Occupy Eugene (1)

- Occupy Fort Myers (1)

- Occupy Hartford (1)

- Occupy Honolulu (1)

- Occupy Houston (1)

- Occupy Indianapolis (1)

- Occupy Iowa City (1)

- Occupy Lansing (1)

- Occupy Little Rock (1)

- Occupy Madison (1)

- Occupy Miami (1)

- Occupy Milwaukee (1)

- Occupy Minneapolis (1)

- Occupy New Orleans (1)

- Occupy Oakland (2)

- Occupy Philly (1)

- Occupy Phoenix (2)

- Occupy Pittsburgh (1)

- Occupy Portland (1)

- Occupy Raleigh (1)

- Occupy Sacramento (1)

- Occupy Salt Lake City (1)

- Occupy San Antonio (1)

- Occupy San Diego (1)

- Occupy San Francisco (1)

- Occupy Savannah (1)

- Occupy Seattle (1)

- Occupy Springfield (1)

- Occupy St. Louis (1)

- Occupy Toledo (1)

- Occupy Tucson (1)

- Ohio (6)

- Oil Pollution Act of 1990 (5)

- Oil Spill (21)

- Purdue (1)

- Oil Spill Liability Trust Fund (1)

- Oklahoma (1)

- Cushing (1)

- Oysters (27)

- Ozzy (1)

- Patricia R. Springstead R.N. (4)

- Penguins (2)

- People Power (103)

- PETA (1)

- Philippe Cousteau (1)

- Plaquemines Parish (4)

- Polycyclic Aromatic Hydrocarbons (7)

- Posters (7)

- Protests (193)

- Red Snapper (4)

- Related Links (3)

- Renewable Energy (1)

- Royal Red Shrimp (4)

- Samantha Joye (11)

- Saudi Arabia (9)

- SBA (1)

- Scientific Reports (33)

- Seafood (48)

- Imported Seafood (2)

- Shrimp (16)

- Silver (3)

- Singapore (1)

- South Carolina (1)

- Sperm Whales (2)

- St. Bernard Parish (2)

- Stuart H. Smith (6)

- Survival (1)

- Sylvia Earle (1)

- Synthetic Genomics (3)

- Tarpon (1)

- Taylor Energy Co LLC (1)

- Terry Hazen (2)

- Texas (8)

- Houston (2)

- South Padre Island (1)

- Texas City (1)

- The Center for Biological Diversity (1)

- Toilet (1)

- Transocean (9)

- Turtles (4)

- U.S. Debt Ceiling (5)

- U.S. Dollar (52)

- US Coast Guard (12)

- US Department of Justice (8)

- US Treasuries (14)

- Vampire (2)

- Vermilion Bay (1)

- Vietnam (1)

- Volatile Organic Compounds (2)

- Webinar (1)

- Whale Sharks (1)

- Wilma Subra (4)

- Wind Energy (1)

- Wisconsin (28)

- Madison (6)

- Woods Hole Oceanographic Institution (4)

- World Hunger (40)

- World Oil Spills (1,057)

- Aghajari Pipeline Oil Spill (2)

- Dalian China Oil Spill (1)

- Eilat Ashkelon Pipeline (1)

- Greenpoint Oil Spill (5)

- Gulf of Mexico Oil Spill (1,023)

- Oil Drilling (157)

- Oil and Gas (139)

- BP (121)

- BP Spill (64)

- bp oil spill (56)

- British Petroleum Stock Price (5)

- Tony Hayward (2)

- BP Spill (64)

- Transocean (6)

- BP (121)

- Oil and Gas (139)

- Oil Drilling (157)

- Iran Oil Spill (1)

- Ixtoc Oil Spill (1)

- Keystone XL Pipeline (8)

- Montara Oil Spill (3)

- Mumbai Oil Spill (2)

- Nigerian Oil Spills (1)

- Nightingale Island Oil Spill (1)

- North Slope Oil Spill (1)

- Ocensa Pipeline (1)

- Prudhoe Bay Oil Spill (1)

- Trans-Alaska Oil Pipeline (2)

- Utah Oil Spill (1)

- Yellowstone Oil Spill (3)

- WWOZ 90.7 FM (1)

- Yemen (5)

- Wikileaks (14)

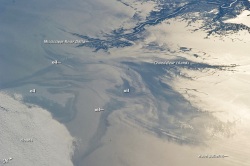

Gulf Oil Spill from the Sky

Gulf Oil Spill 9th Ward Map

Gulf of Mexico Oil Spill Blog

Gulf Oil Spill

- December 2012 (1)

- November 2012 (1)

- October 2012 (1)

- May 2012 (3)

- April 2012 (2)

- March 2012 (3)

- February 2012 (4)

- November 2011 (25)

- October 2011 (107)

- September 2011 (42)

- August 2011 (27)

- July 2011 (38)

- June 2011 (41)

- May 2011 (47)

- April 2011 (75)

- March 2011 (220)

- February 2011 (295)

- January 2011 (206)

- December 2010 (248)

- November 2010 (227)

- October 2010 (132)

- September 2010 (56)

- August 2010 (29)

- July 2010 (32)

- June 2010 (1)

Gulf of Mexico Oil Spill Blog

Gulf of Mexico Oil Spill Blog

Category Archives: Gulf of Mexico Oil Spill Blog

Gulf of Mexico Oil Spill Blog US Zionists Saudi Petrodollar

In a previous article I made the case that China does not hold the position of power over the U.S. economy that many have come to believe. A portion of my argument was focused on disproving baseless claims that China is selling off its U.S. Treasury holdings. As I discussed, China has actually been stockpiling U.S. Treasury securities over the past several years.

This fear-mongering over the fate of the U.S. dollar and dollar-denominated assets has been orchestrated by a barrage of charlatans. As a part of their “doomsday” scenario, they claim that hyperinflation in the U.S. is imminent. Truth be told, as long as the petrodollar remains intact, hyperinflation in the U.S. is not possible. This is a statement of fact. Anyone who claims otherwise has absolutely no idea what they are talking about.

Rather than China, Saudi Arabia ultimately fuels the U.S. economy. Let’s take a look how the Saudi’s have been positioned as the venerable engine of the U.S. economy. In 1971, the final phase of the gold standard was eliminated after Washington refused to honor France’s demand for payment in gold in exchange for dollars.

Prior to that, the U.S. dollar was pegged to the price of gold. Moreover, virtually all other currencies were pegged to the U.S. dollar. Thus, once the U.S. severed the gold standard a global fiat currency system was established, as no currency was backed by gold.

Shortly thereafter in a deal brokered by Henry Kissinger under the Nixon administration, the Saudis agreed to settle all crude oil sales with U.S. dollars. Due to the clout held by the Saudis, the rest of OPEC followed suit. This relationship between the dollar and oil is often referred to as the petrodollar.

The petrodollar serves as America’s most valuable economic lever. It empowers the U.S. economy by means of extortion because one must have dollars in order to buy and sell commodities on the major international exchanges, from oil, gas, gold and steel, to apples, oranges, coffee and cattle. This is the main reason why the U.S. dollar serves as the world’s reserve currency.

Based on its relationship with oil and other commodities, one could argue that the dollar is not exactly a fiat currency since it is backed by the demand for raw materials. Raw materials are in limited quantity. They are also in high demand because they are required for economic growth. They are required for basic sustenance.

Although the petrodollar remains the primary centerpiece controlling global macroeconomics and geopolitical strategy, it’s never mentioned in the U.S. media. In fact, you will be blacklisted if you publicly discuss the significance of the petrodollar. This is precisely what happened to me.

American consumers serve as the superficial driving force of the U.S. economy, but there are a few significant enablers worthy of mention. Certainly, China enhances the economic power of American consumers by providing inexpensive imports. As I discussed in a previous article, China is able to gain numerous competitive advantages over domestic manufacturers by exploiting differences in trade policy with the United States. But this is not the primary force that fuels American consumers.

Inherently one might assume that a strong consumer would be the by-product of higher living standards or higher personal incomes. Enigmatically, the powerful consumer demand seen in the U.S. has not come from a commensurate increase in living standards or personal incomes. On the contrary, as domestic demand has soared over the past three decades, U.S. living standards have trended downward. So what has been the source of this demand?

The ultimate source of fuel for the American consumer comes from the Federal Reserve Bank in the form of credit. Instead of spending more on consumer items as incomes rise, most Americans use credit in order to improve their living standards. As you can imagine, this is not a sustainable path to prosperity.

The majority of the credit created by the Federal Reserve comes by way of fractional reserve lending. Some liken this mechanism to creating money out of thin air. But this money is backed by the petrodollar trade. That is, the demand for dollars increases every time oil is bought.

Thus, when the Federal Reserve wants to print excessive amounts of dollars, the global demand created for dollars through the purchase of oil and other commodities will diminish the inflationary effect that would have been otherwise created within the United States.

While other nations use fractional reserve lending, they face the possibility of hyperinflation at some point because their currency is backed by nothing other than the underlying economy and strength of the government.

Because the United States has been transformed into a consumption-based economy, it must create asset bubbles during periods of weak domestic demand. The Federal Reserve’s ability to create these asset bubbles is enhanced by the petrodollar. Thus, the petrodollar enables the Federal Reserve to form asset bubbles, while exporting inflation throughout the globe.

As discussed in America’s Financial Apocalypse, petrodollar-based inflation is the manner by which the United States taxes the globe. Without the petrodollar the U.S. economy would face very dire consequences. With it, the U.S. can print its way out of messes and force the rest of the world to subsidize its mistakes and finance its asset bubbles via exporting inflation.

Now that you understand how the dollar is linked to oil and other commodities, hopefully you can appreciate that hyperinflation in the U.S. is not possible as long as the petrodollar exists. For instance, hyperinflation would render the dollar as worthless. As a result, no one on earth would be able to afford oil or other commodities.

In a previous article where I discussed China’s role in the U.S. economy, I pointed out that China remains as the largest foreign holder of U.S. Treasury securities because this keeps U.S. interest rates low. And low interest rates means consumers can buy more imports from China.

Unlike China’s export-based economy which depends on low interest rates in the U.S., oil-rich nations could care less about keeping rates low in the U.S. because inflation (which increases when rates are low) causes the price of oil to rise. Thus, Middle Eastern nations spend much more of their petrodollar surplus buying up hard assets such as hotels, restaurants, resorts and other businesses as opposed to investing in U.S. Treasury securities. But of course they do own a decent amount of U.S. Treasuries due to their trade surplus with the United States, and as a symbol of loyalty to the petrodollar arrangement.

How did the Saudis benefit from agreeing to accept only dollar payments for oil?

In return for establishing the petrodollar, the Saudi Royal Family was granted unconditional military support by the U.S. government against all uprisings, both foreign and domestic. As well, they were guaranteed protection against Israel. Finally, the Saudis were assured they could govern their people in any way they chose without the threat of economic sanctions from the United States. This is specifically why Saudi Arabia has not faced sanctions despite its long history of religious and human rights violations.

The one flaw in the petrodollar trade is that despite the fact that a good deal of inflation is exported out of the U.S., eventually some of it will return like a boomerang in a variety of ways. But as far as Washington is concerned, the benefits outweigh the risks because excessive inflation can serve as a means by which to more easily pay off its mounting federal debt. In this way, Washington can have its cake and eat it too because petrodollar economics guarantees that the U.S. will never face a hyperinflation scenario. The petrodollar always creates a win-win situation for the United States. Meanwhile, other nations get shafted.

Despite the obvious importance of the petrodollar, countless individuals continue to warn of hyperinflation in the U.S. Their motive is to get their audience to buy gold so as to raise the price so they can sell it before it collapses. Others don’t care where the price of gold goes so long as they convince people to buy it from them as they slice off 3 or 4 percent of the total in fees.

If you want know whether it’s a good time to buy a house, the last person you should ask is a real estate agent. The same applies to gold. Gold dealers are the absolute worst source of information and insight on gold because everything is spun to manipulate their already biased and largely unsophisticated audience. Even if hyperinflation were to hit the U.S., gold isn’t going to help you one bit. Your best investment would be food, water, guns and bullets.

Iran understands the true significance of the petrodollar, which is why it has been selling its oil for other currencies. Iran’s attempt to disrupt or weaken the petrodollar arrangement serves as the primary reason why Washington initiated economic sanctions against this peaceful nation.

The illegal sanctions imposed on Iran by the Zionist-controlled international community have forced Iran to barter its crude oil for agricultural goods. Iraq, once under the leadership of Saddam Hussein began selling its oil for euros in 2000. Soon after, Washington created lies about WMDs in order to justify invading Iraq. I think you get the point.

Although other nations such as India, China and Germany are now accepting currencies other than the dollar in exchange for their oil, this should not be interpreted as a serious threat to the petrodollar. OPEC dictates the fate of the petrodollar, and Saudi Arabia controls OPEC. However, unified OPEC opposition to the petrodollar could pose as a very challenging dilemma. This has obvious implications for Iran and other OPEC members that are exploring alternative forms of payment other than the dollar.

Similar to other nations considered as “hostile” and “dangerous” by Washington and other Zionist-run establishments throughout the globe, I would imagine that Iran has no intention of allowing itself to go along with globalization mandates. My guess is that Iran’s leaders understand that the real objective of this criminal conspiracy is to abolish sovereignty and transform all complicit nations into slaves of the international bankers, as has already happened to much of the globe.

Iran, North Korea and Venezuela refuse to take part in the globalization agenda engineered by the international bankers. For this, they have been put on a “hit list” by the terrorists in Washington and their foreign associates, as instructed by the Banking Cartel. This is the reality you never hear about. But it is a critical point worth revisiting whenever you come across negative press about these nations.

It is indeed ironic that the manipulation of the global economic system by a Zionist crime syndicate requires the indirect participation of an Islamic nation. This relationship should tell you where the Saudi Royal Family stands when it comes to America’s Zionist agendas.

Muslims of the world, especially those residing in the Middle East should take note of the relevance of the petrodollar. Not only does it function as the economic engine of the United States and the Jewish Banking Cartel, it also serves as the enabler of wars against Islamic nations. Thus, as several key nations continue to explore non-dollar payments for oil transactions, Islamic leaders have a far greater bargaining tool to be used to combat Zionist terrorism and international extortion at the hands of the Banking Cartel.

MS/JR

Continue reading

Gulf of Mexico Oil Spill Blog BP Criminal Charges Largest Fine In History

BP Criminal Charges Largest Fine In History BP to get record US criminal fine over Deepwater disaster BP is set to receive a record fine of between $3bn and $5bn (£1.9bn-£3.2bn) to settle criminal charges related to the 2010 Deepwater Horizon … Continue reading

Gulf of Mexico Oil Spill Blog Class Action Economic and Property Damages Settlement

Class Action Economic Property Damages Settlement Continue reading

Gulf of Mexico Oil Spill Blog One Shrimp At A Time

Gulf Seafood – One of the several usual questions I get from tourists at our shop (aside from, “did it flood here?”) is about the quality of Gulf seafood these days. It should be an assumption that I would not bring out anything I’m not comfortable serving. But maybe they just like to hear it from the guy who actually prepares it, I dunno. Here’s how I feel about it. Continue reading

Gulf of Mexico Oil Spill Blog Gypsy Gina Bp Stroke

Bp has to know how they are making the commercial fishermen starve to take the $25,000.00. Bp has our paper work, and the information needed to at least give us an intern payment, but Bp never helped us at all. Bp must know with a 50ft oyster vessel, crab vessel with 400 traps are just for there looks. Why would Bp ever have a question about the payment if our family has these vessels in our own back yard? Our family are now on food stamps, and getting little help from the church. We own a 50 foot oyster vessel, crab vessel with about 400 trips that we live on to pay our bills, but the spill has made the waters baron with no seafood to support our families living. Continue reading

Gulf of Mexico Oil Spill Blog Time for the Oil Business to Do the Right Thing

“Time for the Oil Business to “Do the Right Thing” by Imogen Reed Is it really two years since the Deepwater Horizon disaster began? For those in the region who saw their livelihoods in the fishing industry, tourism and as … Continue reading

Gulf of Mexico Oil Spill Blog Health risks of the Gulf of Mexico Oil Spill

Health risks of the Gulf of Mexico Oil Spill by Imogen Reed The worry is the potential long-term health effects on public health of the Gulf of Mexico oil spill which only time will tell. It’s like playing a waiting … Continue reading

Gulf of Mexico Oil Spill Blog Wealthy People are Unethical

Created by: Accounting Degree Online source: Wealthy People are Unethical

Gulf of Mexico Oil Spill Blog BP Bad Deal

BP Bad Deal BP to Pay $7.8B to Settle Deepwater Horizon Oil Spill Lawsuit. Is it a Bad Deal For Gulf Residents? On Democracy Now!, investigative journalists Greg Palast and Antonia Juhasz examine who wins and who loses in BP’s … Continue reading

Gulf of Mexico Oil Spill Blog Gulf Coast Detoxification Project

Gulf Coast Detoxification Project Detoxification Program addresses Gulf Coast health challenges Hope at last! Health Concerns have gone unaddressed for too long. Detoxification program providing first sign of real solutions. The Gulf Coast Detoxification Project is open and results are … Continue reading